Paying For Dental Care In Detroit: Smart Insurance & Financing Tips (Without The Jargon)

Clarity First: How Dental Coverage Usually Works

Dental costs can feel confusing—deductibles here, annual maximums there, and different coverage percentages for different procedures. Let’s demystify it so you can plan wisely. Most dental insurance plans operate on three tiers:

- Preventive & Diagnostic (Often 80–100%)

Exams, cleanings, X-rays, fluoride, sealants—highly covered because they prevent bigger problems. - Basic Restorative (Often 50–80%)

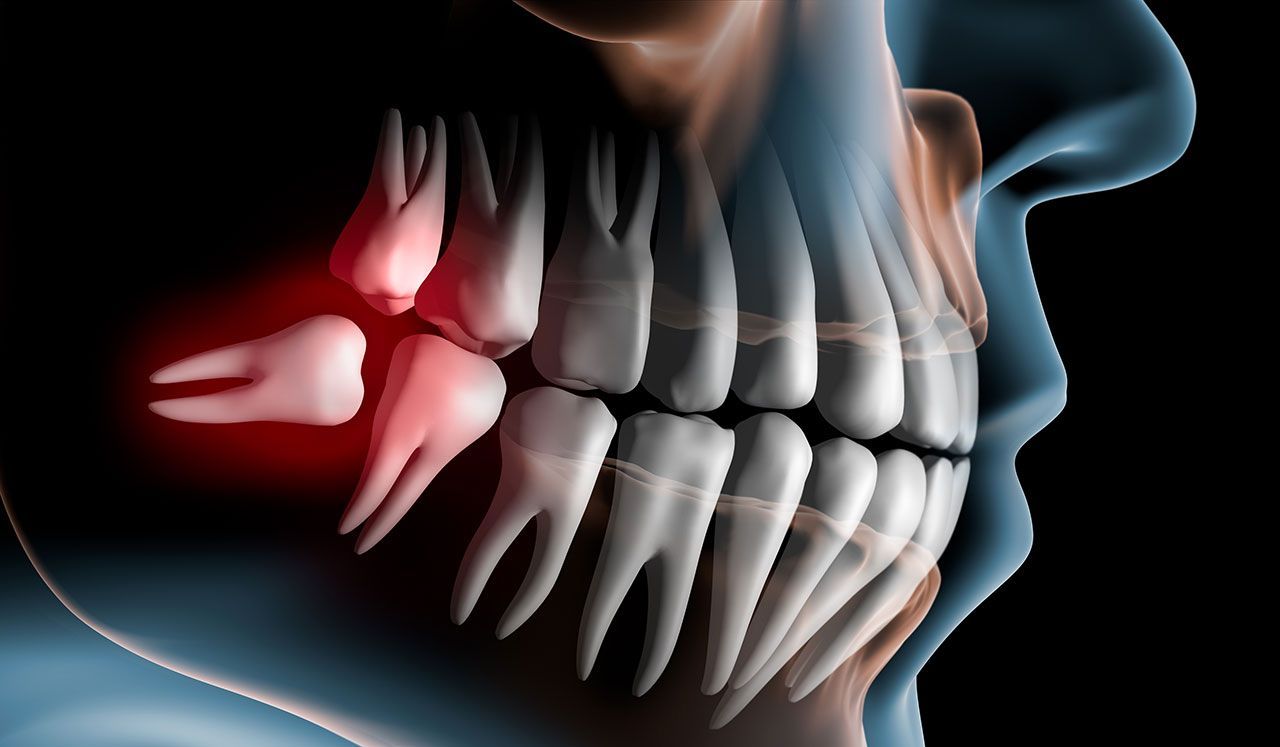

Fillings, simple extractions, non-surgical periodontal therapy. - Major Restorative (Often 40–50%)

Crowns, bridges, dentures, surgical extractions, some implant components (coverage varies widely).

Orthodontics and cosmetic dentistry may have separate rules or limited coverage. Critically, most plans have annual maximums—a fixed dollar amount per year they will pay, regardless of your needs.

Pro tip: Use your benefits strategically—especially near year-end—to complete phases of care before your maximum resets.

Pre-Treatment Estimates: Why They Matter

Before starting significant treatment, request a pre-treatment estimate (pre-auth/pret-D) from your insurer. It’s not a guarantee, but it gives a realistic preview of coverage based on your plan’s rules, remaining maximum, and waiting periods. WOW Dental can help submit these quickly so you know what to expect.

HSA, FSA, And Tax-Advantaged Dollars

- HSA (Health Savings Account): Pre-tax funds you can use for eligible dental expenses; funds roll over year to year.

- FSA (Flexible Spending Account): Pre-tax dollars you must typically use by year-end or lose (some plans allow grace periods).

- HSAs/FSAs commonly cover braces, aligners, crowns, implants, dentures, and many other dental services—check your plan’s list.

Financing: Smoothing The Cost Curve

Third-party financing can turn large one-time fees into predictable monthly payments. WOW Dental works with popular healthcare financing partners and offers phased treatment plans to match your timeline and budget. Many patients combine financing with HSA/FSA funds to minimize out-of-pocket strain.

Building A Budget-Friendly Plan

- Phase 1: Stop disease & pain (urgent fillings, extractions, root canal therapy).

- Phase 2: Stabilize function (crowns, partials, interim solutions).

- Phase 3: Long-term upgrades (implants, veneers, full-arch options).

This approach prevents emergencies from derailing progress and keeps each step affordable.

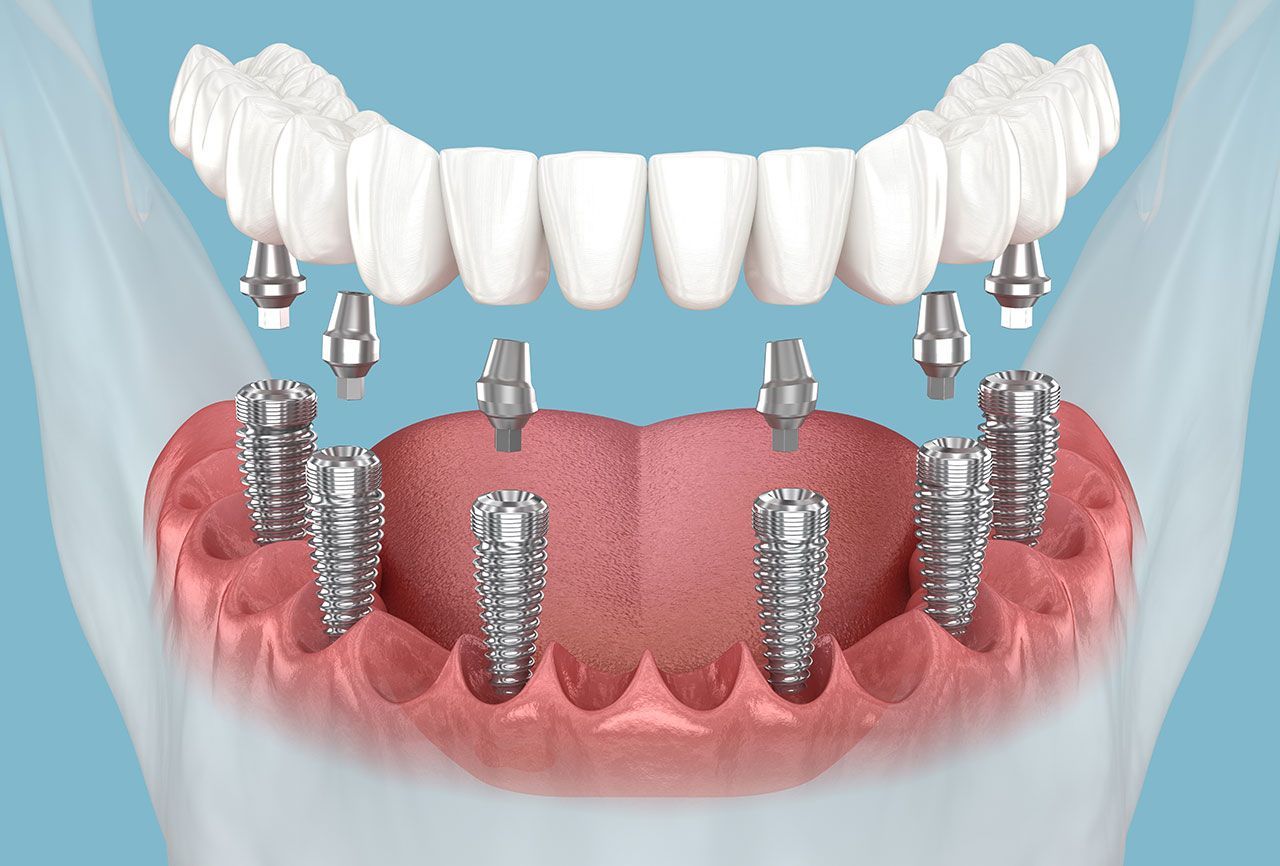

Implants, Dentures, And Orthodontics: Coverage Cliffs To Watch

- Implants: Coverage varies dramatically—some plans cover the crown or abutment but not the implant body; others offer partial benefits or none. Ask specifically about D codes if you have them to see what’s included.

- Dentures & Partials: Often covered under major services with replacement frequency limits (e.g., once every 5–7 years).

- Orthodontics: May have a lifetime maximum separate from the annual maximum. Clear aligners are typically covered similar to braces when ortho is included.

Maximize Your Benefits With Good Timing

- End-of-year strategy: If your plan renews January 1, consider starting treatment in late fall so portions post to two benefit years—helpful for crowns, implant phases, and perio therapy.

- Splitting arches or phases: For dentures, implants, or full-mouth cases, staggering care can spread costs across years and maximize coverage.

- Recall visits: Two cleanings and periodic exams/X-rays per year often have the highest coverage—don’t leave those on the table.

Case Examples (Hypothetical)

- Crown Today, Implant Later: You break a molar. Insurance helps with an immediate crown now; if the tooth fails later, you plan an implant next year using fresh benefits and HSA funds.

- Perio Plus Restorations: Treat gum disease first (to protect future work) before investing in crowns/bridges—often required by insurers and smarter clinically.

- Aligners With FSA: Use FSA funds for the initial aligner fee, then finance remaining payments over treatment length.

Transparent Estimates & No-Surprise Planning

WOW Dental provides written treatment options with clear line items: procedure codes, estimated insurance portions, your portion, and optional add-ons (like night guards or whitening). You’ll know:

- What’s medically necessary now vs. what can wait,

- What’s covered vs. elective,

- Which financing options are available, and

- How to phase care to fit your budget and benefit calendar.

FAQs

Why is my medical insurance not covering dental care?

Medical plans cover accidents or specific medical conditions; routine dental services are handled by dental insurance, which has different rules.

Why does my plan “downgrade” fillings?

Some plans pay for the least expensive acceptable material (e.g., silver amalgam), then you cover the difference for a tooth-colored filling. Your estimate will show this.

Are whitening and veneers covered?

Usually considered cosmetic and not covered. If a veneer or crown is needed to restore function (fracture, large failing fillings), coverage may apply under major services.

What if I don’t have insurance?

Many patients use financing, in-house savings plans (if offered), or phased care. Preventive visits remain the best value—small problems stay small.

Your Next Step: Make A Plan You’re Comfortable With

Bring your insurance card (or plan details) and any questions about HSAs/FSAs to your consultation. WOW Dental’s team will outline at least two paths to your goal—showing total cost, estimated coverage, and monthly payment options—so you can proceed confidently.

Call or book today:

East Detroit: 18525 Moross Rd, Detroit, MI 48224 —

(313) 371-9880

West Detroit: 22341 Eight Mile Rd, Suite 200, Detroit, MI 48219 —

(313) 730-4111